Beta Hedging against Up-beta and Down-beta

When would we want to use an equal-weight vs. beta-hedged?

Beta Hedging with Up-beta and Down-beta

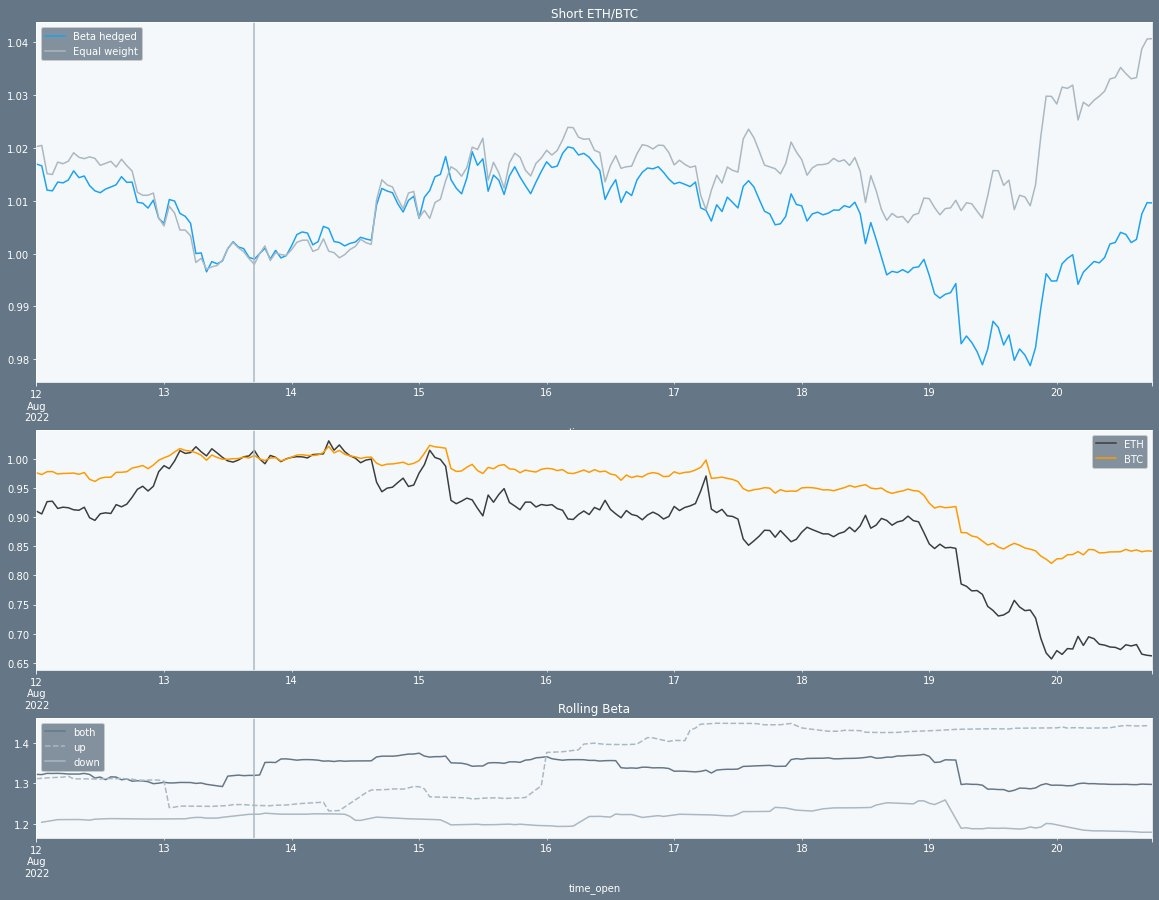

An equal-weighted ETH/BTC outperformed a beta-hedged ETH/BTC construction during recent market move

An equal-weighted ETH/BTC outperformed a beta-hedged ETH/BTC construction during recent market move

This is due to the difference between beta, up-beta, and down-beta

When would we want to use an equal-weight vs. beta-hedged?

Definition

First, will do a few non-mathy definitions:

(using round numbers for examples)

Beta is how much of the altcoin moves vs. BTC (market), so:

- beta of 1 means altcoin moves 1% when BTC moves 1%

- beta 2 = 2% when BTC 1%

In a theoretical world, you’d be flat if hedged (this would also be a pointless position in theory)

Separating Up and Down

Up-beta is that same definition, only on days when BTC was positive

Down-beta is that same definition, only on days when BTC was negative

What’s interesting about looking at these separately, is that we find that betas are closer to 1 on down days than up-beta or both

We showed a theoretical hedge is pointless — but the world is not theoretical, and no hedges are clean

And what we find is that a down-move on BTC, results in short ETH + long BTC strategy showing less than theoretical profit (since the ETH short didn’t pay for the hedge)

Beta Hedge vs. Directional Bets

Then why even place a beta-hedge at all? You’d only do it to bet purely on the altcoin by removing the market.

And if that wasn’t the case — e.g. deciding to use up-beta or down-beta or whatever — you probably have enough insight to make the straight directional bet

And once you have that insight, you can look to do equal weight for margin reasons or to express specific view on the interaction between altcoin/market (ETH/BTC)