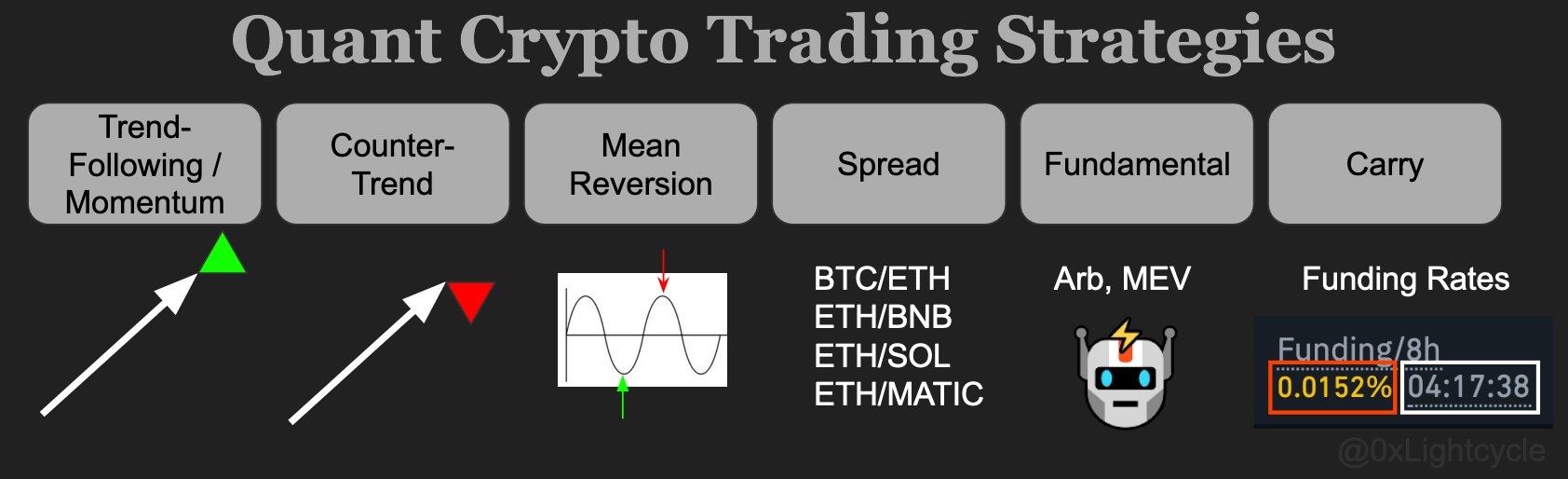

Quant Trading Strategies

Trade six types of strategies

Trade six types of strategies

If you have momentum trades, add in a system for mean-reversion. If you have trend-following trades, add some carry strategies. +5 from one strategy, could be -4 from the other and it’ll auto-reduce scale

The purpose of trading different classes of strategies is to reduce correlation between your strategies. The more orthogonal your strategies, the better your equity curve.

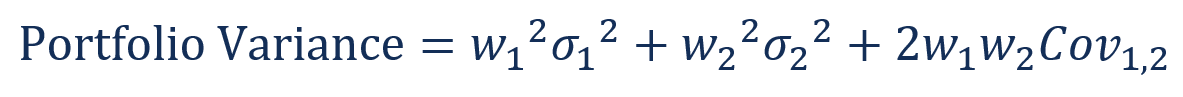

This equation shows you how the more uncorrelated your strategies, the better (lower) your portfolio variance:

Can’t find enough ideas to get six? Start with Carry and Trend, these are the most basic. In crypto, this would be funding rates and apeing into whatever is hot (only slightly kidding).

As you get more advanced, add in Fundamental (Arb, MEV, cross-chain). Then keep going.